Content

Your tax rate will vary between .2 percent and 5.4 percent, due to a number of factors. You may contact your local tax field representative to secure your tax rate for the current tax year or for a previous tax year. The request will be reviewed by MDES staff before authorizing the closure of your account. A Status Report (Form UI-1) must be completed online or submitted to your local tax field representative. You may also need to contact the Mississippi State Tax Commission, the Worker’s Compensation Commission, and/or the Internal Revenue Service.

However, you will receive a debit memo indicating payment was not made at the time of report filing. Generally wages are reported to the state in which the services are performed. You can then use the seven-digit EAN and six-digit PIN to create an online account at des.nc.gov to manage your unemployment tax information and respond to unemployment claims. You can look up your Covid-19 Recovery Assessment rate by logging in to your UI online account. Employers must send employees a W-2 form at the beginning of every calendar year to report earned wages and deducted taxes for the previous calendar year. The Idaho Department of Labor’s employment services, Job Corps, unemployment insurance and labor market information programs are 100% funded by the U.S.

Pay via regular check using payment coupon

Detailed information on how the premium rate for the Aggregate State Number is calculated is provided in theHandbook for Employers. Enterprises that fail to file registration documents within the 30 day requirement will be subject to penalty. A 3 percent “Increase for UC Delinquency” will be added to the tax rate that would otherwise be assigned. Willful failure to comply could also result in civil fines and criminal prosecution under Section 802 of the PA UC Law. New PA employers must register within 30 days after services covered by the UC Law are first performed for the employer.

- Employers meeting certain requirements in the law may be designated as Seasonal Employers.

- Learn more about the the Square Payroll settings for MA Paid Family Medical Leave.

- After MDES has processed the report, you can view your report by successfully logging into Online Unemployment Services and selecting “Inquiry”.

- A 3 percent “Increase for UC Delinquency” will be added to the tax rate that would otherwise be assigned.

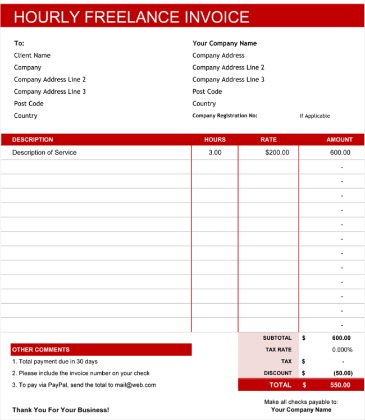

- Companies of all types use it for tax filing and reporting purposes.

- If you are already registered as an employer for unemployment tax and have an Employer Account number click here.

Yes, however the client must be registered with MDES and provide MDES with the client’s own federal identification number. A cross-reference to the leasing company’s federal identification number may be established, if requested by the employer or the employer’s representative, for federal reporting purposes. A penalty for late filing is charged beginning 30 days after the due date of the report. The amount of penalty for late reporting is an additional 10 percent of tax due.

Step 1 – Create a username and password.

Appellate services to resolve benefit eligibility and unemployment tax liability disputes. No report for the last month of the quarter is to be submitted. The last month of the quarter is to be included in the quarterly report. No report for the last month of the quarter How Do I Find My Employers Ean is to be submitted. The PEO must keep separate records and must file separate quarterlyPremium and Wage Reports (LB-0456/LB-0851)for each client under their Client Number. The client’s premium rate each quarter will be the premium rate for the PEO’s Aggregate State Number.

The exact time will vary depending on your individual circumstances. Your local tax field representative will be able to discuss the factors, which will affect your tax rate. At the time you are eligible for a modified rate, your tax rate may increase, decrease, or remain the same. All wages must be reported under the state unemployment insurance number issued for the work site employer.

How do I find my employers EAN

Check your email for instructions on how to activate your account. Please follow these instructions from the MA Department of Unemployment Assistance to authorize us. Look this up online or on the Rate Notice mailed by the MA Department of Unemployment Assistance each year. This feedback is used only to improve this Support Center article and is not sent to our Support team. Questions requiring a reply can be sent from the contact link at the top of this page. The process of getting a state EAN also varies considerably from state to state.

Wages paid by Seasonal Employers are potentially excludable from being used in the determination of unemployment benefits. Seasonal Employers carry on all work operations and employ workers during a regularly recurring period of twenty-six consecutive weeks or less within a calendar year. An employing unit that is a non-profit organization as described under section 501 of the IRS https://quick-bookkeeping.net/ code and has four or more employees during each of 20 weeks in the current or preceding calendar year. Officers of a nonprofit corporation are counted even if such officers do not receive remuneration for their services from the nonprofit corporation. The employee does not have to be the same person for twenty weeks. It is not relevant if the employee is full-time or part-time.

The Covid-19 Recovery Assessment rate is assigned to employers based on the business’ UI contribution rate. Once you receive your UI rate, you can look up your Covid-19 Recovery Assessment rate by logging in to your UI online account. Learn more on the MA Department of Unemployment Assistance website. NOTE – If you are unable to file your quarterly and/or monthly report on time, you may request a quarterly and/or a monthly filing extension, which must be received on or before the filing due date. Send an email with your account number, the quarter and year, or the month and year of your request Employers meeting certain requirements in the law may be designated as Seasonal Employers.

- Employers must reapply for Seasonal Employer designation on an annual basis.

- When you file for a state EIN in certain states, you will get both your state EIN and an Unemployment Insurance tax rate.

- Total penalties generally will not exceed 20 percent for any calendar quarter.

- Only businesses with one or more employees, including those who are an employer of household workers, need to get a state EIN.

- In addition to saving money, you will have the satisfaction of knowing that your new employee is someone you have trained and who is familiar with your business.

- Be sure to have your business corporate name or partner’s names, and trade name, mailing address, federal ID number, and other identifying information when you call.

MDES uses a formula based on the taxable wages you reported to us during the last four quarters which were due prior to the election year. Equal payments will be made for calendar quarters March, June and September and settlement will be made for any overage or shortage at the time payment is due for the December quarter. State law requires all employers to electronically submit employment tax returns, wage reports and payroll tax deposits to us. A corporation operates without any employees except for the corporate president.